The firm offering small business 401(k) plans has adopted the 401k related provisions of the Coronavirus Aid, Relief, and Economic Security (CARES) Act.

West Jordan, Utah – Apr 2, 2020 – 401GO is pleased to announce the company’s immediate capability to support the 401(k) retirement plan related components of the recently passed Coronavirus Aid, Relief, and Economic Security (CARES) Act that was signed in to law on Friday, March 27, 2020. The federal government has acted with a rapid comprehensive response to the Coronavirus pandemic with the goal of providing immediate relief and options to the majority of Americans. In the spirit of this response, 401GO has already instituted several CARES act provisions allowing all current and new clients to take full advantage.

The CARE act is now permitting Coronavirus related distributions which allows up to $100,000 to be withdrawn or taken as a loan from a 401k plan if the 401(k) account holder, their spouse or dependent is suffering from Covid 19 or is financially impacted by the Coronavirus pandemic such as the loss of income, employment, quarantine, child care, etc.

Specific to Coronavirus related penalty free withdrawals, 401GO will allow any impacted employee to self-certify their qualifications and not withhold federal income tax unless otherwise elected. Additionally, employees will be able to repay the withdrawn amount anytime over the next 3 years. Please note, there are income tax related consequences to taking such a withdrawal but the CARES act is providing relief, such as spreading the tax implications over 3 years.

Specific to 401(k) Loans, 401GO is allowing new loans to be initiated for up to $100,000 or 100% (whichever is less) of an account’s vested value with deferred payments of 1 year. Additionally, any pre-existing 401k loan holders can request a 1 year reprieve on additional loan repayments.

401GO CEO Jared Porter states, “Even though we offer retirement accounts geared towards future goals, our goal at 401GO is to give employers and their employees participating in their 401k plans to have more options available during this unprecedented time in our history. When we built 401GO just a few years ago, we made the strategic decision to host our 401k plan offering on our own proprietary, custom-built technology to give us the flexibility to make 401k plans more nimble and free from the constraints of third party providers. This flexibility has enabled us to be more agile in offering this new capability that is in keeping with the spirit of what our country needs right now. Even though we never imagined a crisis like the Covid 19 pandemic, we are pleased we can provide these options to our clients so quickly and hope the rest of the 401k industry can also respond with similar expediency and urgency.”

For additional information and a full list of features, please visit 401go.com

About 401GO

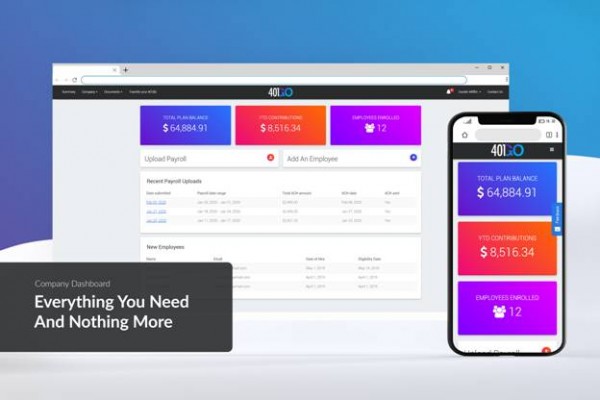

Founded in 2018, 401GO has a mission to make 401(k) plans accessible to all businesses. Whether it’s a new startup plan or an existing 401(k), setup and administration can appear quite daunting but they have made it as quick, easy and painless as possible.

Media Contact

Company Name: 401GO, Inc.

Contact Person: Daniel Beck

Email: Send Email

Phone: 8012142125

Address:8427 S. Old Bingham Hwy

City: West Jordan

State: Utah

Country: United States

Website: http://www.401go.com